Taking the two most traded juices on the market: frozen concentrated orange juice concentrate (FCOJ) and apple juice concentrate (AJC), Fruit Juice Focus analyses imports and exports in Africa over the past decade.

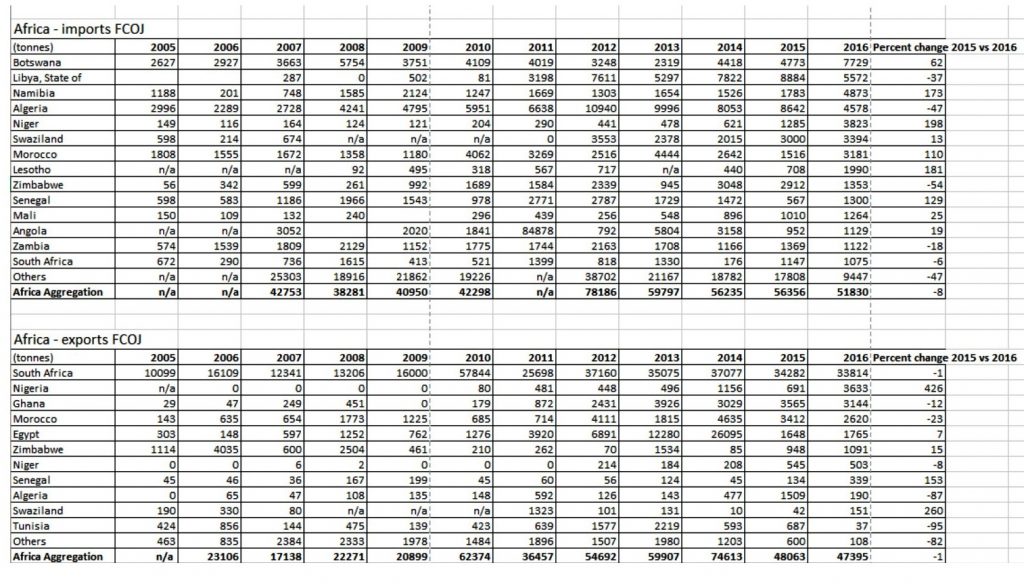

FCOJ imports

Uptake of FCOJ in Africa has seen some fluctuation over the past few years. Imports spiked at 78 186 tonnes in 2012, primarily due to a surge in imports to Nigeria (not shown on table) which saw shipments increase ten-fold on the previous year to over 17 000 tonnes. Overall though, the region’s FCOJ imports have been fairly stable since 2007, ranging between 40 000-50 000 tonnes per year.

FCOJ exports

While there has been a decline in FCOJ exports in the last couple of years, African shipments have shown significant growth over the past decade. Exports reached 74 613 tonnes in 2014, helped by a notable increase from Egypt, which sold 26 095 tonnes to foreign markets – more than double the volume from the previous year.

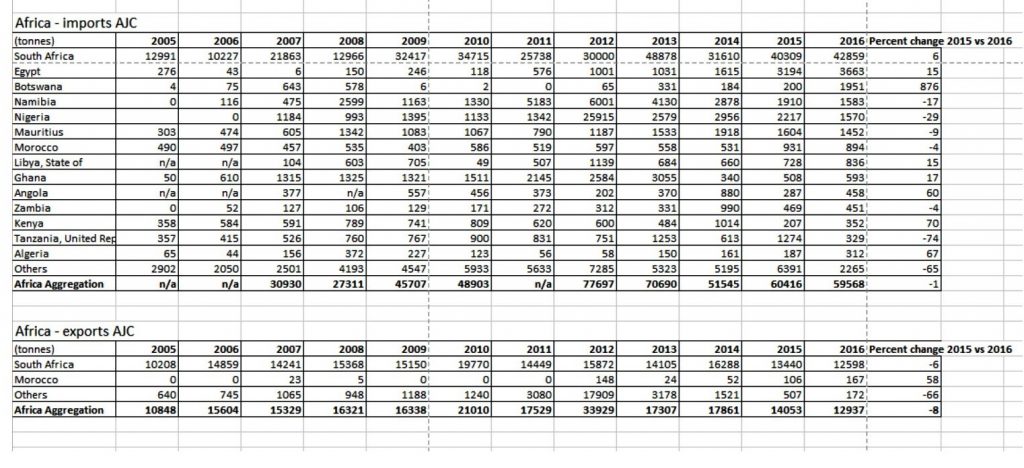

AJC imports

Africa has more than doubled its imports of AJC over the past decade. Again there was a notable spike in imports to Nigeria in 2012, which pushed total African uptake that year to 77 697 tonnes. South Africa is the largest importer of AJC in Africa, but in both 2006 and 2008, the country was a net exporter of the product.

AJC exports

Apple concentrate exports out of Africa are fairly minimal. Countries such as South Africa produce good volumes, but also consume a lot. Exports reached a peak of 33 929 tonnes in 2012 – twice the level from the previous year. This increase is attributed to very high shipments from Swaziland (not shown on table) which sold 16 602 tonnes.