Editor Caroline Calder finds out how the Turkish fruit juice industry is fairing today, with some key questions to juice association MEYED.

“In the last five years Turkey has shown a significant hunger for imported products, and this trend is mainly driven by urbanisation,” Euromonitor International nutrition analyst Dimitrious Dimakakkos commented in a recent interview.

“This has resulted in the traditional food markets being substituted by modern grocery retailers, and multinational branded products (have) found more space on the shelves of supermarkets.”

Reports say that 18.9% of Turkey’s GDP is taken up by the food and beverage industry. Why? Turkey is the ideal location for agriculture production. The nation is the seventh largest agricultural producer in the world, for a wide variety of products. Turkey is also a heavy importer to cater to a huge internal market of 76 million people, and an important hub for producers to reach the Middle Eastern and North African markets around it.

CC- When was the association founded?

MEYED – The Turkish Fruit Juice Industry Association (MEYED) has been established in 1993 in order to bring the companies in the Turkish fruit juice industry together under the same roof. As the only representative of the industry, MEYED has 39 members.

From the first day of its foundation, MEYED has brought industry’s stakeholders from the areas of agriculture, food processing and health, expert academicians and the professionals from the industry together in order to put forward solutions for the common issues and contribute to the development of the industry.

CC – What has changed over the years?

MEYED – Our industry and our association has continued to grow every year. Many new companies have joined us during this period. With the developing technological infrastructure, products of the desired quality are produced and exported.

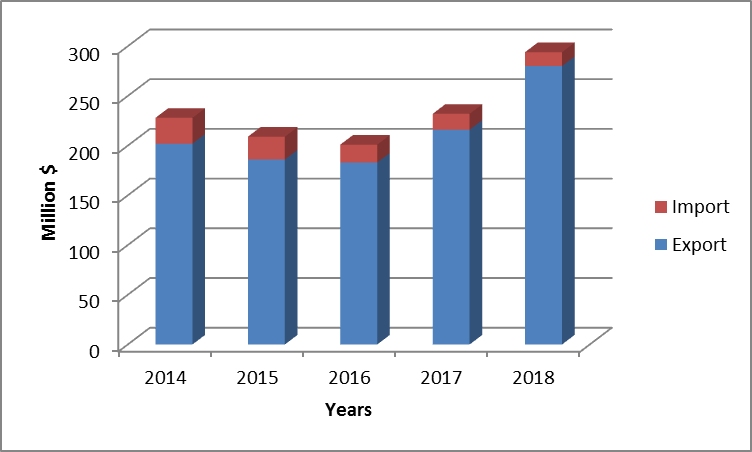

The export of fruit juice industry started with symbolic figures in the 1970s but by the 2000s it had a big increase. In 2018, the export value approached 300 million dollars. Today we export our products to more than 130 countries.

CC – Who are your members typically?

MEYED – members are all the fruit juice producers and some supplier companies from packaging and auxiliary material industries.

Most of the products produced for export are concentrates and widely exported concentrate types are like apple, citrus, cherry, pomegranate.

In the domestic market, consumers prefer mostly nectar types such as peach, apricot and cherry. Producers focus on production in line with the preferences of consumers. However, they are not limited to them, many product options are offered to the consumers.

CC – What are the biggest challenges for your members that you can help with? Geography, politics, transport, trade?

MEYED – One of the most important issues in our industry is the losses in the raw material supply chain. In order to find a solution to this problem, it is important to work in coordination with farmers and other stakeholders.

Before the harvest period, agriculture and procurement experts come together to determine the yield estimates for that year. The whole sector designs the logistics and production processes in a coordinated way. MEYED creates the necessary environment to provide them to work together.

CC – What aspects are unique to the Turkish industry?

MEYED – Consumers around the world mostly drink orange juice. But consumers in Turkey generally prefer the nectars. The most preferred flavour is peach nectar, it is followed by cherry and apricot nectar. The industry offers products to the market in accordance with these preferences. Turkey has an important position in the world in the production of concentrates of these products.

CC – Where do you see growth for the industry

MEYED – Fruit juice and nectar consumption in Turkey is about 8-9 liters per person in a year. It is still quite low compared to other countries.

But Turkish fruit juice market is growing rapidly and with the effect of healthy nutrition trend, consumption in our country is expected to continue to increase.

CC – Do you get involved in marketing and branding?

MEYED – We have a digital platform where we promote fruit juice with its positive impacts on agriculture, economy, nutrition. We believe in continuous communication based on scientific facts and statistical figures.

Round up of export and Import trade

Turkey’s Fruit Juice Foreign Trade (Million $);

[Import and export trade – fig 1]

The availability of large quantities of fruit allowed the establishment of exportoriented, sophisticated and efficient fruit juice plants in Turkey. Exports of fruit juices and concentrates started with a symbolic quantity of 6 tonnes in 1970, and after that showed a rapid and steady increase, reaching approximately 103 thousand tons in 2012. Generally, apple, citrus (mainly orange) and pomegranate juice concentrates are produced for exporting. In addition to them, sour cherry juice and some fruit nectars, mainly peach and apricot, are produced for the domestic market and some are exported as well.

The Netherlands and Germany constituted 35% of Turkish fruit juices and concentrates exports in 2012. The United Kingdom, the USA and Italy were among the key export markets in 2012.

The growth of opportunity for exports is obvious, just looking at total imports of agricultural products from Turkey to the USA in 2018 the figure totalled USD1 billion. Leading categories included: processed fruit & vegetables (USD191 million), tobacco (USD173 million), snack foods (USD121 million), other vegetable oils (USD116 million), and fruit & vegetable juices (USD89 million).

Background:

The fruit juice and concentrate industry has become one of the progressive agroindustry sectors in Turkey. This export-oriented industry has flourished rapidly due to the modern production units, new investments and strong support of abundant fresh fruit production. Fruit juices of various types (concentrated, mixed, sweetened etc.) are very popular primarily because of their nutrient content. The products of this sector are also good alternatives to carbonated beverages.

Fruits processed into fruit juice and concentrates are apples, pears, apricots, peaches, oranges, tangerines, grapefruits, lemons, sour cherries, strawberries, pomegranates and grapes.

Meyed.org.tr, ustr.gov, foodturkey.com.tr