Fruit Juice Focus analyses the past five years of imports of mango and passion fruit juice concentrates into key consumer countries including the Netherlands, Germany, France, the UK and the US.

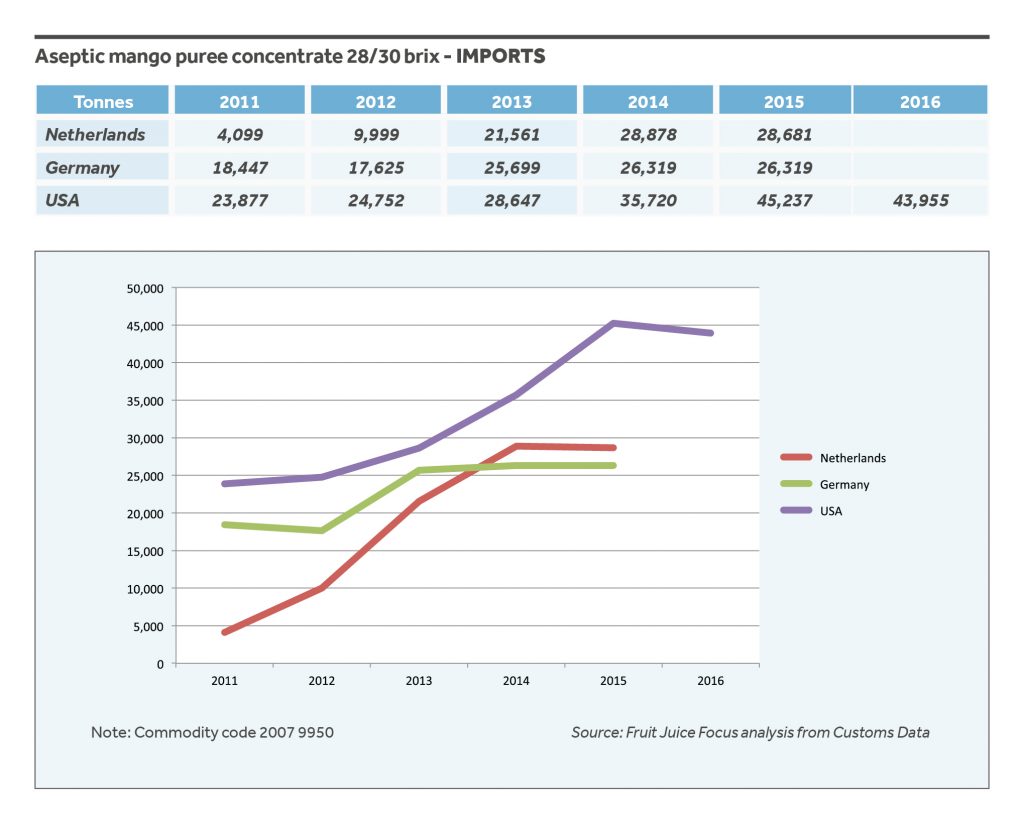

Mango

Aseptic mango puree concentrate 28/30 brix imports have shown steady growth in the three countries analysed below with all showing a surge in demand between 2011 and 2014. While figures indicate a levelling off in 2015 and 2016, the increased popularity of mango juice over the last few years can’t be ignored. Tropical blends on the supermarket shelves are commanding more space as consumers look to expand tastes.

Imports into the Netherlands, for example, more than doubled in 2012 against 2011 with an even greater jump in 2013 up to 21,561 tonnes against the 2012 figure of 9,999 tonnes.

Imports into the US have increased steadily from 2011 through to 2015 with 2016 showing a slight drop in demand of around 3%. Most of these supplies would have been delivered from South America – particularly Colombia.

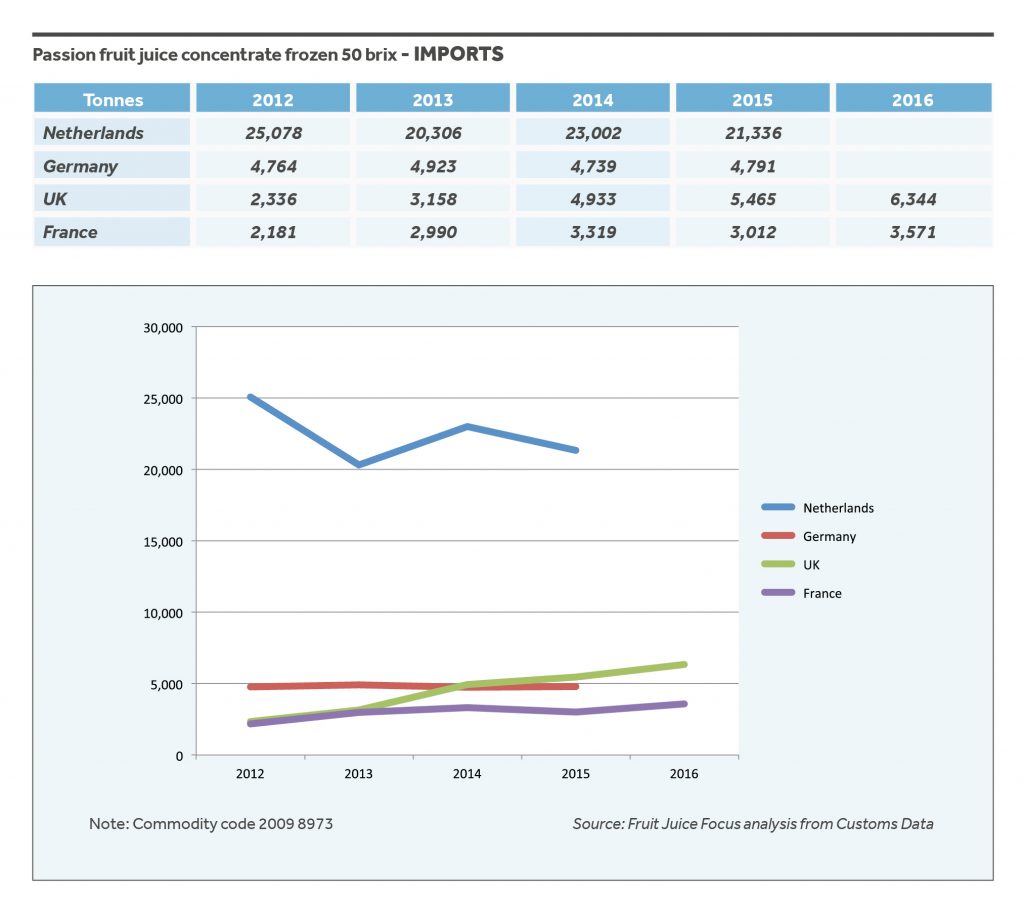

Passion fruit

Imports of passion fruit juice concentrate (50 brix) show steady growth in the UK and France for the period 2012 though to 2016. The sporadic supply to the Netherlands could be attributed to the volatile pricing that the passion fruit juice concentrate market is subject to. Production in top-producer, Ecuador, rises and falls corresponding to local fruit pricing – usually in a three-year cycle. Passion fruit juice concentrate has traded for up to USD15000 in the past few years. Current pricing is around USD7000/tonne.