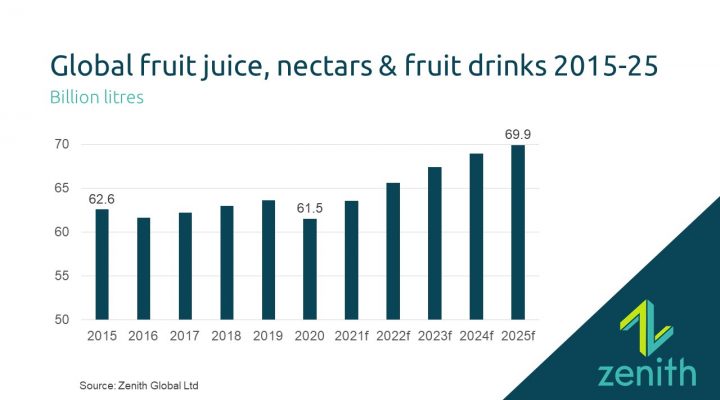

According to data from Zenith Global’s Globaldrinks.com database, global volume sales of fruit juices, nectars and juice drinks (FJNJD) fell by 3.3% in 2020 to 61.5 billion litres, writes Christina Avison, Associate Director – Commercial, Zenith Global

While worldwide consumption had been growing incrementally pre-pandemic, boosted by positive performance in Asia Pacific, Latin America, Middle East and Africa, volumes had been falling in Europe and North America in the years to 2019. The significant factors behind waning demand include price, sugar content and lack of consumer enthusiasm despite huge investment into innovations that have failed to create proportional impact.

Value sales have shown more strength reflecting an increase in average prices thanks to rising premiumisation of the category and stable demand from the hospitality sector. This had been the main route to competing with other liquid refreshment beverages and achieving success in a densely packed competitive marketplace.

In 2020, there was an overall drop in value worldwide of more than 7%. Retail purchasers of juices opted for larger SKUs and multipacks thanks to reduced shopping trips, bigger basket sizes and to meet the needs of more of the family confined to the home. There were also several months of the year where next to no sales were achieved in the HoReCa channel, and smaller packs designed for on-the-go consumption and convenience purchases also suffered with reduced footfall in major centres across the world due to quarantines, lockdowns and shelter in place guidance.

Markets where FJNJD are highly popular in convenience and hospitality like Spain and Japan were worst hit by value declines, with any uptick in retail sales unable to make up for losses in HoReCa and on-the-go volumes while typical consumers stayed home and relied instead on fresh fruit and homemade juices.

Furthermore, with a fall in higher value channels, brands suffered significantly greater losses in markets across North America and both East and West Europe where, despite increases in private label sales in the year, this was not able to offset a decline in the top brands’ value sales in single serve packaging.

Value sales too are expected to recover more quickly, growing at a stronger CAGR than volume at around 5% per annum to 2025.

Pandemic panic

It is well documented that when flu season hits, orange juice consumption spikes. With the threat of a far worse virus in 2020, demand for juice rocketed – the highest peak seen across the review period – especially in markets like the US, Germany and the UK. Juice, with its natural health credentials, is seen as a convenient and simple way to consume nutrients for adults and children alike.

Immune support became an overnight top priority for consumers fearful of contracting the coronavirus, so healthy and functional juice drinks came more sharply into focus. Shoppers stocked up amid fears of shortages, especially in ambient and long-life SKUs. In the early months of the global pandemic, orange juice prices were boosted significantly by this surge in purchasing and elevated by concerns over supply chain continuity and labour shortages in Florida and Brazil.

In 2020, Zenith Global observed a rise in the number of juice brands proactively promoting the health benefits of juice consumption to the growing population of health-conscious consumers seeking better-for-you beverages. No more so than in Australia, where it was announced in August 2020 that the Australia and New Zealand Ministerial Forum on Food Regulation rejected the Australian government’s proposal to retain its five-star Health Star Rating for 100% juices. Fruit and vegetable juices are now assessed on the same footing as sugar-sweetened beverages including CSDs despite having zero added sugar, with some products now allocated as low as 2.5 stars thanks to high naturally occurring sugar content.

Sugar crush

There is still a limited understanding amongst some consumers and lawmakers regarding inherent vs added sugars in juice, yet consumers are easily convinced by claims of sugar reduction. This has undoubtedly been one of the key factors shaping global juice consumption trends and the trigger for falling volumes in a number of the largest world markets.

Consequently, investment in technology to reduce sugar in juices is gathering pace, with biotechnology company Better Juice recently landing USD8 million in seed round funding. Its enzymatic technology process will be carried out in a new manufacturing plant in Israel which claims to reduce sucrose, fructose and glucose content in fruit juices without reducing the nutritional or prebiotic value by converting these sugars into non-digestive compounds, such as dietary fibres, gluconic acid and sorbitol.

Another favoured way to reduce fructose is to use vegetables in juice blends. Adding vegetables like carrots or beetroot to juice drinks has also shown to increase a consumer’s identification with healthful messaging.

Constant evolution, marketing and reformulation continue in the juice category and this was not slowed by the pandemic. In the UK, PepsiCo launched Tropicana Lean in September 2020 with a lower sugar content and market leader Innocent Drinks released Innocent Super Light in March 2021. In the US, Coca-Cola’s Half Naked range performed significantly better in 2020 than Naked’s standard range, with its Naked Protein portfolio also seeing triple digit growth in the year as consumers turned to functional properties.

Functional juice

Functionality beyond the natural health benefits of a fruit-full diet is high up on the list for consumers in a mid- and post-pandemic world. Not just supporting general health and wellbeing, juices marketed with added benefits like immune boost, added vitamins and minerals and support for fighting off colds and viruses have been boosting sales in the category. Ingredients with particular health markers like ginger, matcha, spirulina, turmeric, celery and açai resonate with consumers and further highlight the health halo.

Some of the key launches in the last 18 months include:

- Granini, Spain: brought out a new range of fortified immune support nectars.

- Morinaga Milk Industry, Japan: launched Sunkist Super Grape enriched with polyphenols to support gut health and cardiovascular health.

- Plantly, Australia: released enhanced juicy water ‘Defence’ which includes echinacea extract and high-vitamin C fruits and vegetables like sweet potato, apple and carrot for an immune boosting hit.

- Innocent, UK: relaunched super smoothies, now containing double the vitamins.

- So Good So You, USA: introduced two new immune boosting juice shots to its existing range.

Premium flavours

The high price of juices and juice drinks relative to other refreshment beverages continues to be one of the key challenges to future growth in the category. However, premium flavours remain a stronger selling point than price with consumers seeking a more sophisticated adult beverage than juices shared with the whole family. Inspiration from cocktails gives a real treat feel to the juice category, especially during lockdowns, with PepsiCo capitalising on this adding new flavours to its Tropicana Premium Drinks line like Pina Colada and Strawberry Kiwi Sunrise.

While key flavours like orange and apple continue to dominate on a global scale, grape, pineapple, cherry and cranberry have remained steady and less volatile to changes experienced in the last 18 months.

The return of breakfast

One of the key reasons cited for stagnating or declining juice sales is the hectic nature of modern life and the change over the last 50 years from a family breakfast sat around the table with a glass of juice to the modern bustle of grab-and-go convenience foods, meal replacement drinks or skipping breakfast altogether.

However, with more of us staying home in the last year than ever before and rediscovering the simple pleasures of enjoying extra family moments to connect, breakfast – and by extension, juice consumption – may be set to be a positive change that households opt to keep as we move into the new normal.

Riding this renewed momentum for juice and maintaining new or returning customers gained throughout the pandemic will be key to ensuring future growth. Zenith Global certainly believes this is possible, with a bright horizon forecast for FJNJD for the first time in a long time.